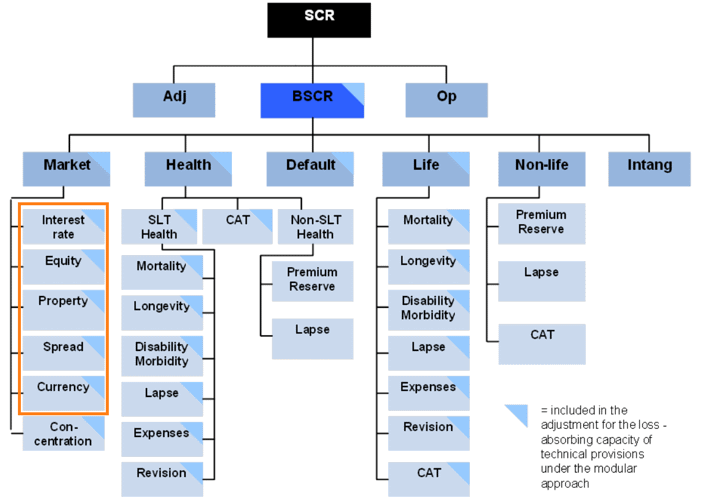

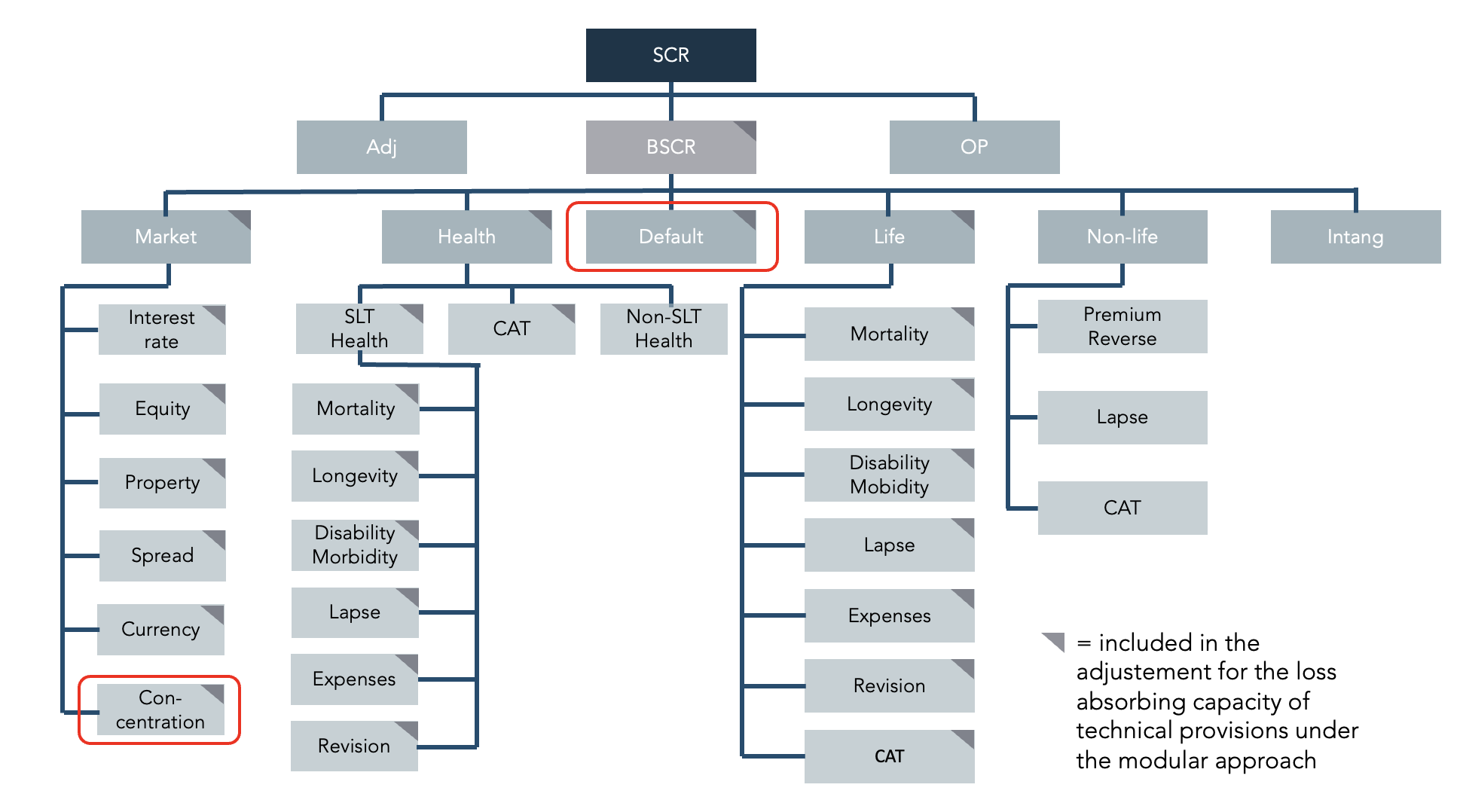

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

GitHub - MBKraus/Solvency_II_Spread_Risk_Capital_Charge: Python script for calculating the spread risk solvency capital charge ("SCR") for a bond portfolio under Solvency II (along the standard formula)

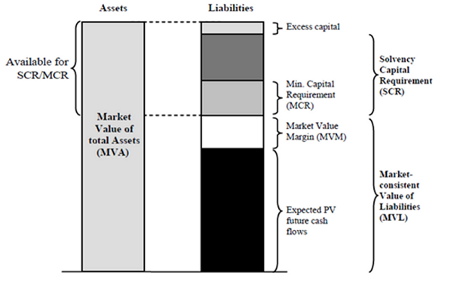

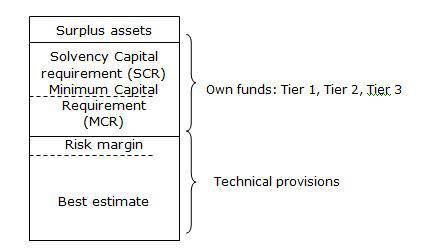

Insurance mathematics III. lecture Solvency II – introduction Solvency II is a new regime which changes fundamentally the insurers (and reinsurers). The. - ppt download

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar